How Businesses Achieved Greater Efficiency and Effectiveness with Quantexa's Decision Intelligence Platform

A quick-look at a new Total Economic Impact™ study conducted by Forrester Consulting, exploring the cost savings and business benefits enabled by Quantexa.

Organizations continue to wrestle with how to maximize the value of their data to empower growth, strategic planning, risk management, and everyday operations. Multiple systems for record keeping, duplicate records, and manual processes for gathering data from multiple sources leads to inefficiencies, high numbers of false positives, and inconsistent data that can cost enterprises valuable time and resources to reconcile.

Organizations realize they can overcome these challenges by leveraging the power of data, but they lack the means to derive true, quality data to drive effective and efficient decision-making.

That's where Quantexa comes in.

Our Decision Intelligence Platform enables a reusable and renewable trusted data foundation that supports multiple use cases and enables the use of AI and advanced analytics to improve operational and data management efficiency, improve the customer experience, have stronger compliance postures, and simplify legacy technology.

"Quality data...enables improved anticipation of customer needs, cost reduction, development of personalized solutions, and better risk management."

The Total Economic Impact™ Of The Quantexa Decision Intelligence Platform, 2024

A quick overview

To illustrate the value our Decision Intelligence Platform brings to organizations across financial services, telecommunications, and government, we commissioned Forrester Consulting to conduct a 2024 Total Economic Impact™ study and examine the return on investment enterprises may realize by deploying our technology. Forrester interviewed various roles including Chief Data Officer, AML Transaction Monitoring Lead, Global Head of Financial Crime Detection, Head of Technology and Innovation, and more. The purpose of the study is to provide readers with a framework to evaluate the potential financial impact of Quantexa's platform on their organizations.

To fully understand the potential costs, benefits, and risks associated with investing in our technology, Forrester interviewed representatives from six organizations and government agencies that are actively using our Decision Intelligence Platform.

Forrester then aggregated the expertise and results of those interviewed to create a composite global financial services organization with 2 million institutional customers who generate 20% of its $50 billion yearly revenue.

This article shares a quick-look at the key insights and results seen from a composite organization representative of the interviewed customers.

“We wanted a more automated solution to make the switch from a rule-based system to a more advanced, analytics-driven solution.”AML Transaction Monitoring Lead, Financial Services

Key findings

The study shows how Quantexa's Decision Intelligence Platform enables organizations to break down data silos and connect internal and external sources together to create a single view of customers, counterparties, transactions, and third-party data in context. Having this single, contextual view allows enterprises to understand who they are doing business using data analytics.

As Forrester reveals in the study, which extends the composite organization model over three years, organizations can leverage the trusted data foundation created with Quantexa's Decision Intelligence Platform to "augment and automate decision-making across multiple use cases, data management, customer intelligence, Know Your Customer (KYC) standards, financial crime compliance, risk management, fraud, and security. Quantexa’s Platform can also be key to enabling effective use of AI across an organization by having access to a more accurate data foundation and by augmenting and automating decisioning."

The representative interviews and financial analysis found that by leveraging Quantexa's Platform, the benefits were positive for the composite organization:

Key statistics

The following results are for a composite organization representative of interviewed customers.

228%Return on investment over 3 years

$50MBenefits present value over 3 years

8 monthPayback period

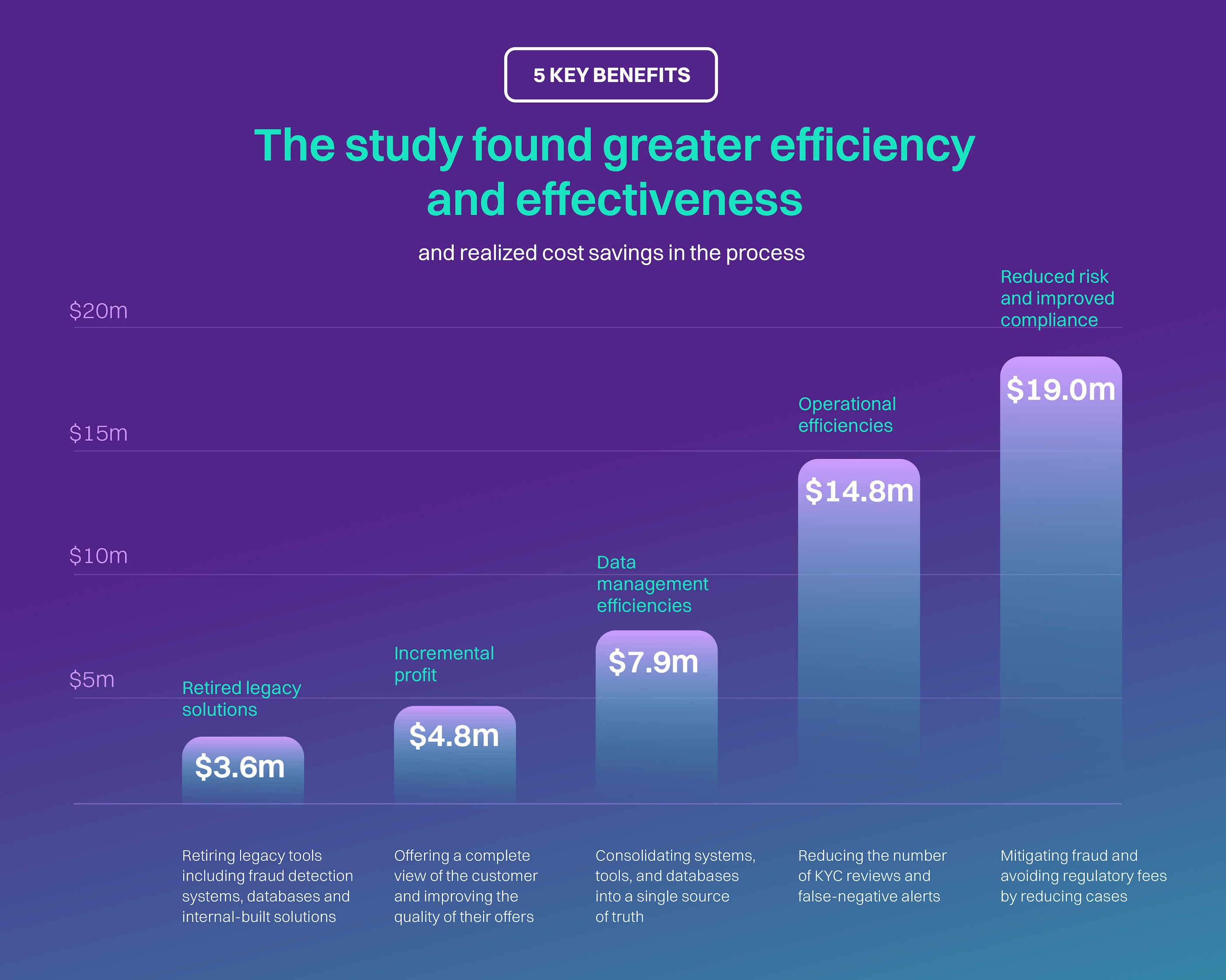

Quantitative benefits for the composite organization based on a three-year, risk-adjusted present value included:

Data management efficiencies savings worth $7.9 million

Operational efficiencies worth $14.8 million

Reduced risk/improved compliance worth $19.0 million

Incremental profit from improved customer intelligence worth $4.8 million

Cost savings from retiring legacy solutions amounting worth $3.6 million

“We have seen a 15% reduction in duplicate customer records.”Head of Technology and Innovation, Telecommunications

Unquantified benefits that provided value for the composite organization but are not quantified for the study included:

Flexible and simplified architecture. Complexity is reduced as multiple use cases can leverage the same data platform.

Strategic relationship to fight financial crimes. By cross-sharing data with other entities and industries, companies can create an ecosystem that helps fight financial crime

Improved ability to investigate complex anti-money laundering, fraud, and financial crime cases. With the Quantexa Decision Intelligence Platform, organizations have better customer visibility and more time available to investigate complex cases than they had with other solutions.

Enabling AI success. Improved data quality is an important foundation for the application of AI across the organization and good-quality data means machines provide higher-quality output.

Improved relationship with regulators. Interviewees said their relationships with regulators are stronger because they are more confident their organizations are able to manage all the data and take a more proactive approach to fraud.

Better customer onboarding and customer experience. Quantexa enhances the overall onboarding and customer experience due to improved KYC capabilities and better customer insights.

Improved employee experience. Quantexa removes part of the manual and repetitive work by automating and streamlining tasks. Employee experience and related metrics such as engagement and retention improve.

“We saw an immediate benefit when we implemented Quantexa. [It was] on average a 50% to 75% noise reduction. So, [it led to] a huge reduction in the number of investigations.”

Global Head of Financial Crime Detection, Financial Services

The three-year journey

Based on the three-year journey for the composite organization Forrester describes in the study, the composite organization realizes benefits within the first year after deploying Quantexa's Decision Intelligence Platform; then continues to add new use cases each year. The three-year timeline in the study looks like this:

Year 1: Entity Resolution (including data ingestion, unification, and aggregation) and KYC use cases are deployed at the beginning of Year 1. Two use cases are live during Year 1. Graph analytics and networks, scoring, and alerting all come as standard capabilities as part of the core implementation.

Year 2: The composite organization implements fraud management, financial crime, and anti-money laundering (AML) solutions. Five use cases go live from Year 2 onwards.

Year 3: The organization implements a customer intelligence capability across 25% of its global coverage. A total of six use cases are live during Year 3. The composite organization later adds additional use cases and expands its customer intelligence use case to other departments and regions.

“This has been a massive step in the right direction in terms of monitoring transactions and catching the bad guys.”

AML Transaction Monitoring Lead, Financial Services

Loading...

Loading...