Risk Management

Unite and maximize disconnected data and operations. Automate and align lending decisions to enhance resiliency. Improve customer experiences to facilitate precise and sustainable lending.

Take the guesswork out of credit and lending decisions

Traditional risk management solutions can't provide a clear understanding or consistent view of a risk ecosystem, preventing sustainable lending. Revolutionize your risk management approach by connecting siloed data to make context-driven decisions that reduce credit and lending risk.

HOW WE SOLVE IT

Revolutionize risk management with context

Develop 360-degree views of all parties

Connect internal and external data to build true, real-world entities and expand your understanding of borrowers and their relationships with other entities.

Surface hidden connections quickly

Use Graph Analytics to monitor portfolios of any size and dynamically reveal connections that aren't possible using traditional matching approaches.

Incorporate non-traditional data

Apply external data models into your scoring pipeline and incorporate multiple, disparate data sources to inform risk and credit decision-making.

Empower efficient credit assessments

Get real-time and early risk warning signal detection – up to 18 months in advance – about customers, counterparties, and their relationships.

THE IMPACT

What we have achieved

faster aggregation of indirect links to non-customer counterparties

reduction in deduplication of customer IDs resolved to single entities

detect warning signals with longer lead time

The advantages of managing risk with Quantexa

WHERE WE HELP

Strengthen resiliency with better risk-based decisions

Portfolio Monitoring – Early Signals

Uncover proximate and emerging risks within the borrowers’ ecosystem, driving proactive alerts and delivering accurate early warnings.

Holistic Counterparty Profiling

Connect internal and external data to query aggregated risks for a clearer understanding of counterparty hierarchies, supply chains, and their relationships in real time for greater risk resiliency.

Sustainability

Drive profitability through positive environmental and social impacts, and foster long-term resilience, by unifying internal and external data sources for a contextualized understanding of climate and human rights risks.

Get an overview of Quantexa’s Risk Management solutions

category-leading technology

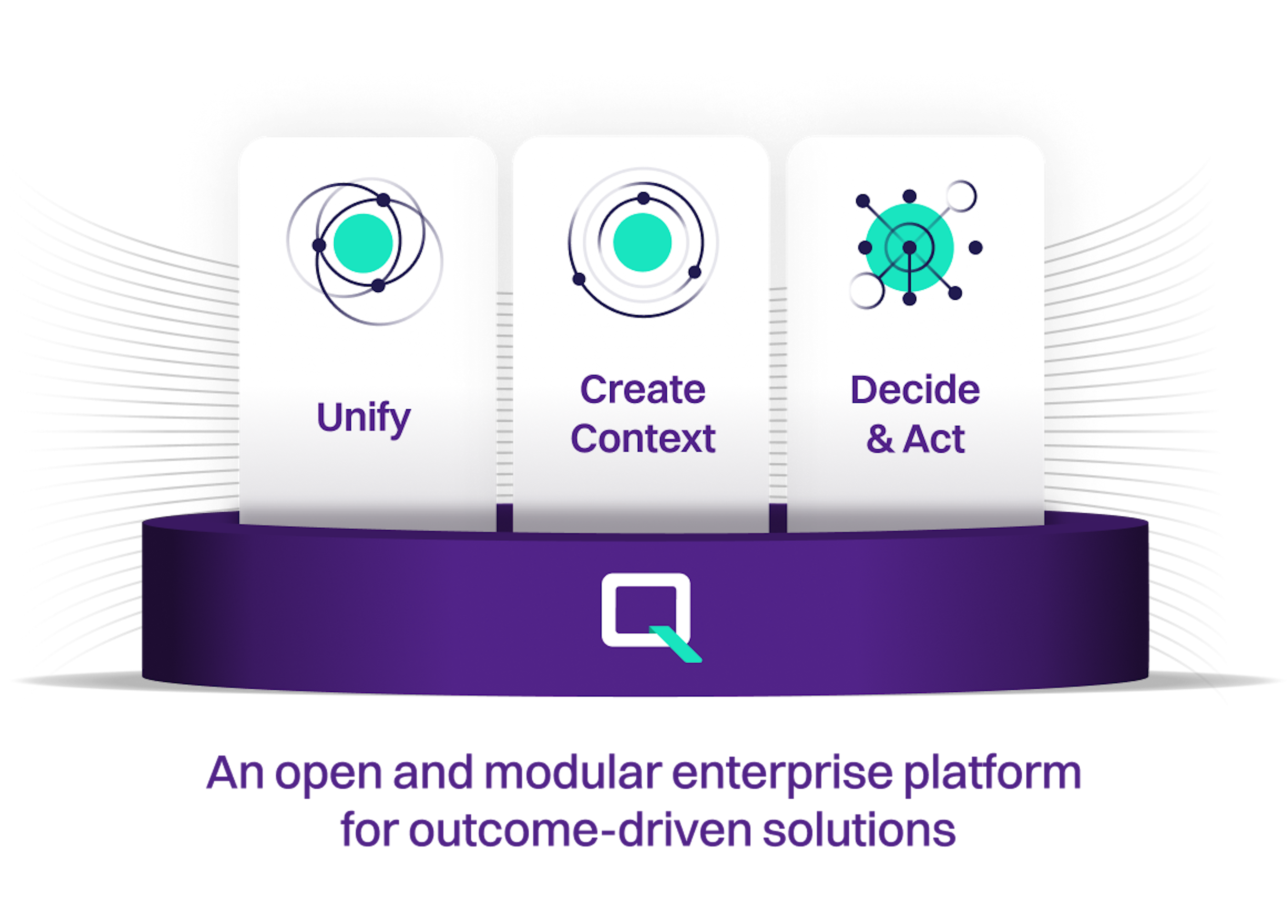

Our Decision Intelligence Platform

Build a single view of data and create a culture of confidence around critical decision-making that protects, optimizes, and grows your organization.

Generative AI

Human/AI decisioning for Risk Management

Leverage Q Assist to expedite risk monitoring and management processes, credit decisioning, supply chain management, and ESG.

Decision Intelligence solutions built on our platform

Data Management

Build a trusted data foundation to deliver context for decision-making.

Learn moreCustomer Intelligence

Enhance customer experience and accelerate revenue growth with a 360-degree connected view of customers.

Learn moreKnow Your Customer

Detect risk in real time to identify unknown risks and deliver more accurate risk ratings.

Learn moreFraud and Security

Uncover hidden fraud risks with a contextual approach to detection and prevention.

Learn moreFinancial Crime

Take a unified approach to fighting financial crime and fraud with our Contextual Monitoring solutions.

Learn moreAML and Investigations

Reduce false positives and focus on real risk by modernizing your AML monitoring, detection, and investigation.

Learn moreFAQs

How will you strengthen my risk assessment strategy beyond what I’m already doing today?

We enhance the work your teams are already doing by providing more efficiency and effectiveness. With market-leading technology, we connect internal and external data for a single view of the borrower, furthering your understanding of their direct and indirect relationships including customers and suppliers in the supply chain. With these advanced capabilities, we can continuously monitor profiles for long-standing risk even beyond a single entity.

Quantexa Risk solutions consist of Portfolio Monitoring – Early Signals and Holistic Counterparty Risk Profiling. Unlike most early warnings solutions that focus on financial and behavioral and event-driven drivers only, our platform goes beyond this and adds supply chain, transactional behaviors, news, and industry views to accelerate warnings 18-24 months in advance. Counterparty Risk Profiling analyzes assessments across sales, legal, and credit structures for a broader understanding of the borrower and counterparty networks to help accurately identify risk.

With open architecture, we seamlessly integrate with existing systems, allowing teams to input connected networks to their existing models and continue to use their current, preferred tools to enhance performance.

It sounds like you’re selling a financial crime-related tool, how does it relate to credit risk?

You’re correct in that our market-leading technology was originally designed for financial crime detection. However, the challenges for financial crime and enterprise risk users are comparable. Both need a single view of the customer, a single view of counterparties as well as an understanding of relevant context around them. With our unique, connected context built through advanced capabilities, we can leverage the success in financial crime and apply this to a more advanced approach to enterprise risk that ultimately facilitates enhanced risk management.

I’m looking to strengthen my risk resiliency strategy overall. Credit risk is a part of that but how would you add more value to my overarching approach?

In addition to our solutions which drive early warning signals and strengthen your regulatory approach to counterparty profiling, we improve risk data hygiene and support immediate and long-term resiliency strategies enterprise-wide. With advanced capabilities and our enriched view of the borrower’s ecosystem, we enhance credit models and portfolio performance by monitoring and identifying second-order risk impact through a context-driven understanding of connected exposures and indirect borrowers, we can automatically aggregate and assess market sentiments. With context, we clearly identify counterparties to offboard and pinpoint risky exposures that align with a given risk appetite.

Our modernized, data-driven processes position Quantexa as your partner to not only strengthen risk resiliency but also improve client experiences and growth across your organization over the long term.

I’m looking to use news as a source for early warning signals. Is this something I can do with Quantexa?

Quantexa provides access to over 80,000 news publishers from around the globe, averaging ~1.2M news articles per day. Every article is enriched using industry-beating AI to transform unstructured news articles into structured news data, which includes granular category, industry, and entity tags. This enables you to easily configure sophisticated queries that pinpoint relevant news and proactively monitor warning signals related to your specific risk landscape.

Latest from Quantexa

Loading...

Loading...DRIVE INDUSTRY TRANSFORMATION

Speak to an expert

Protect, optimize, and grow your organization with Decision Intelligence. More is possible with the right data in the right context.