Unlock the power of Decision Intelligence

Protect, optimize, and grow your organization today.

There’s no room for error in the Know Your customer (KYC) process for banks. It’s vital for financial institutions to establish and verify the identity of customers, fully understand the nature of their customers’ activities and relationships, and to assess whether there are potential risks associated with those customers – including evidence of suspicious activity such as money laundering and terrorist financing.

Yet, banks around the world struggle with complexities and inefficiencies that undermine the effectiveness of their KYC programs – and expose their business, brand reputation and customers to risk. These issues often stem from the need for KYC teams to rely on highly manual and time-consuming work in the due diligence process, work with a broad range of data types form internal and external resources and navigate the severe limitations of legacy technology systems used in KYC decision-making.

Surfacing financial crime risk can be particularly challenging with corporate clients, which can have several subsidiaries, beneficial owners and hierarchies, business lines, and regional operations. Financial criminals know the KYC process is a weak spot for many banks, and they take full advantage of it by creating complex networks of corporate structures and shell companies that help them evade detection.

Like many financial institutions, ABN AMRO Bank N.V., one of the largest Dutch banks, wanted to modernize its KYC program and make its KYC investigation process more intelligent, efficient, and effective. To achieve that goal, it sought a next-generation technology solution – and found what it was looking for in Quantexa’s Decision Intelligence (DI) Platform.

“Quantexa’s DI platform has allowed our investigative teams to greatly reduce time spent on gathering data, understanding that data, and trying to differentiate between legitimate and potentially suspicious activity.”

Paul Weststrate

Product Owner, ABN AMRO

“We wanted to better understand the connections between the companies we serve as a bank – our clients – and to improve the data and information quality in our KYC process,” says Paul Weststrate, Product Owner, at Amsterdam-based ABN AMRO. “In a proof-of-concept (PoC), Quantexa demonstrated that it had the capabilities to address our key challenges. Also, Quantexa’s DI Platform combines both Entity Resolution and network analytics – and that’s a strong combination.”

ABN AMRO’s PoC with Quantexa – which was dubbed “New Client Take-On” – focused on KYC onboarding and kicked off in late 2019. The effort was sponsored at the bank by Robin de Jongh, Head of Detecting Financial Crime, and Nancy Schot-Steketee, Detaching Financial Crime Grid Owner. Through the PoC, the bank wanted to assess the Quantexa DI platform’s capacity to process large data volumes, ingest various data sources, assess potential risks associated with customer data, and identify legal hierarchies for ABN AMRO’s corporate clients.

Improving data quality for the KYC process was a top priority for the bank, as it understood that having quality data was a must if it were to achieve more effective KYC analysis. With Quantexa’s dynamic Entity Resolution, ABN AMRO could connect billions of data points across internal and external data sources in real-time or batch to create a single, enterprise-wide view of people, organizations, places, and more.

The PoC with Quantexa focused on executing entity resolution on ABN AMRO’s internal client database and worldwide company registry datasets. The joint delivery team for the PoC – which was carried out remotely during the height of COVID-19 pandemic lockdowns – included professional services firm Synechron, one of Quantexa's delivery partners. Synechron led the project, trained staff on the delivery, and eventually took over management of the Quantexa implementation.

According to Weststrate, the bank was impressed that Quantexa’s DI platform required little customization for the PoC, as the solution was ready to work with its native data formats and schemas in batch and real-time data pipelines. Weststrate says ABN AMRO also appreciated that it could use its existing, cloud-based, enterprise data lake solution – Azure Data Lake Storage – for the project, which helped to reduce costs and development time.

By June 2021, the PoC had moved out of production, and the user interface (UI) for the bank’s custom application to access Quantexa’s DI platform was rolled out to a specific group of analysts at the bank. “We initially implemented the UI for KYC teams that execute more complex and time-consuming investigations,” says Weststrate. “It did not take long for these teams to find it required less effort for them to understand the data about clients and its context. Also, because KYC activities now take less time and it’s easier to identify criminal networks, our teams can focus more on investigating real financial crimes.”

He adds,

Quantexa’s DI platform has allowed our investigative teams to greatly reduce time spent on gathering data, understanding that data, and trying to differentiate between legitimate and potentially suspicious activity.

Paul Weststrate

Product Owner, ABN AMRO

By combining Entity Resolution and Graph Analytics using the Quantexa platform, ABN AMRO has significantly enhanced its data quality and increased its KYC team’s ability to detect complex connections and networks and surface hidden risks. And because of the project team’s heavy focus on compliance during the PoC, the bank can conduct its modernized approach to KYC with confidence, knowing that activities are in alignment with all relevant data privacy-related legislation

Additionally, by using Quantexa’s DI technology, ABN AMRO’s KYC analysts can now quickly and easily access an extensive set of internal and external data, including 30 million accounts from a commercial data provider, to inform their client reviews and decision-making processes.

“By bringing together the bank’s extensive data on Quantexa’s DI Platform, we can connect the dots within the data and construct a global view of parties, transactions, relations, and more.”

Paul Weststrate

Product Owner, ABN AMRO

The bank has amplified KYC team efficiency and productivity and reduced costs through the automation of tasks and streamlining of processes that have eliminated many manual tasks. ABN AMRO has also been able to improve the client experience, Weststrate says, by reducing friction all along the client life cycle and minimizing outreach for KYC information and documents – including the need to make repeated requests for that data.

Since it completed the KYC onboarding PoC in 2021, ABM AMRO has been working to enhance the value of its project with Quantexa, including adding more risk information relevant for financial crime investigations, such as interrogation information and external information like sanctioned entities and watchlists. The KYC solution currently uses the bank’s database, company registry, client transaction details, and information about offshore data leaks.

“We want to produce data regarding resolved entities and their networks and use that information in other capabilities for detecting financial crimes,” says Weststrate. “We also need to bring in risk identification and interpretation logic to further aid our investigations and automate more KYC activities.”

ABN AMRO has also been making Quantexa’s capabilities available to a wider group of KYC and financial crime compliance analysts. And it has plans for its data scientists and innovation teams to combine their expertise with the context-rich data Quantexa provides to build new risk models and scores and help address other use cases across the bank, according to Weststrate.

The bank also plans to use insights from Quantexa’s DI technology in the internal “Feature Store” that its teams can access within the platform. The intent, Weststrate says, is to see how other teams at ABN AMRO can use this high-quality data and transactional information to enhance their own investigations.

ABN AMRO’s initial deployment of Quantexa’s DI platform was so successful that the bank was recognized by research and advisory firm Celent with the “Celent Model Risk Manager 2022 Award” in the category of data, analytics, and artificial intelligence (AI). A detailed case study about the award is available here.

Protect, optimize, and grow your organization today.

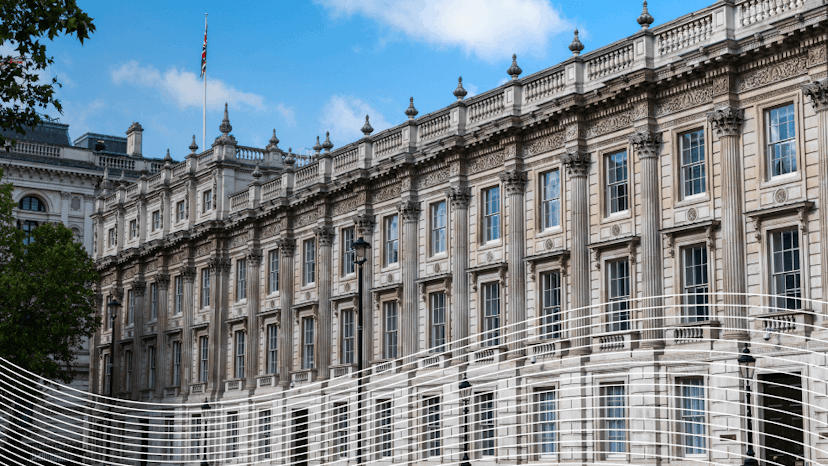

By leveraging the power of Decision Intelligence, the U.K. Government aims to recoup millions in fraudulently claimed loans granted during the pandemic — and arm lenders and other departments with insight to prevent future economic crimes.